29 November 2021

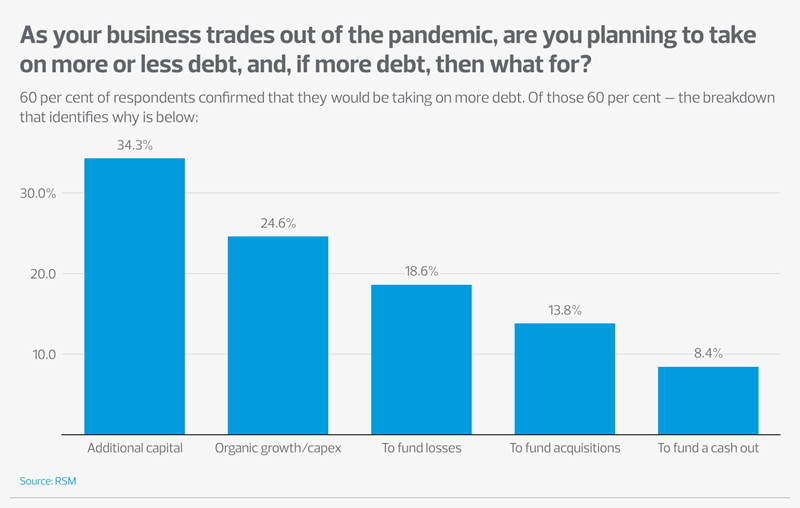

Debt is on the increase in the manufacturing sector. Our recent survey found that more manufacturers have increased their debt levels compared to the start of 2020 than decreased them, and the majority of manufacturers expect to take on more debt as they trade out of the pandemic.

- 44.5 per cent of manufacturers confirmed their debt levels are higher than before the pandemic

- 60 per cent of manufacturers confirmed they are planning to take on more debt

Companies are starting to regain confidence following the pandemic, and are looking to finance their operations in a way that gives them a more efficient cost of funds. One important reason that mid-market companies are willing and able to take on more debt to meet their financing needs is the greater variety of debt products to fund growth and development.

On top of the classic bank market we’re all familiar with, there are now two different types of lender, the asset-based lender (ABL) and the debt fund, both of which have been part of the US mid-market scene for some time.

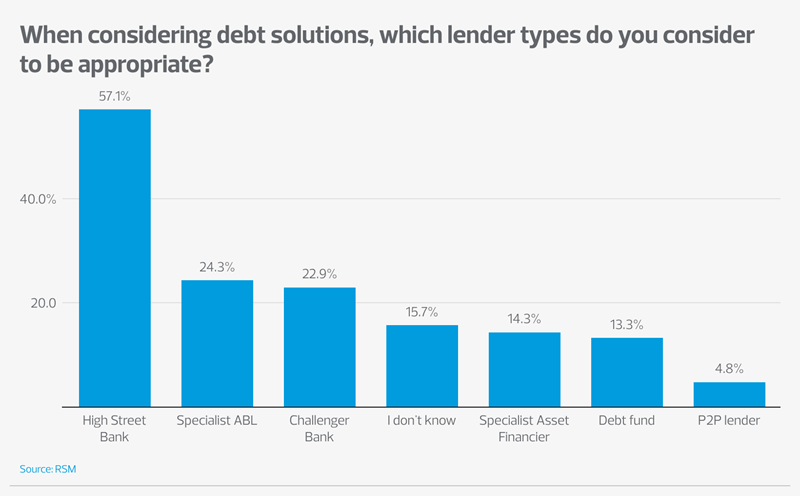

All this choice can leave manufacturers wondering which is the best option. It’s no coincidence that the increase in available debt options has come at the same time as a rise in the use of debt advisers. It’s also unsurprising that about a sixth of respondents are unclear on what lender types are appropriate to them.

Borrowers are increasingly seeking out the convenience of a knowledgeable link into the market, and the reassurance that they are being presented to lenders in the best possible way. Conversely, more lenders have come to expect that the opportunities they see are appropriately packaged and presented.

Debt options

Asset-based lenders (ABL)

ABL providers offer businesses ‘receivables-led’ financing, where the focus is on raising money against trade debtors. This means that businesses can access higher levels of potentially cheaper borrowing by giving lenders closer control and monitoring rights over their invoices than they would get under conventional banking arrangements.

A surprisingly low proportion of respondents – only a quarter – think that specialist ABLs are an appropriate option for them. Manufacturing sector invoices are well-liked by the ABL market due to their ‘sell and forget’ nature.

In addition, many specialist ABLs will also look to finance against property, as well as plant and machinery, which may prove an attractive one-stop-shop solution. Given its cost effectiveness and flexibility to accommodate working capital demands, this is a market worth considering. Firms looking to increase headroom or finance growth, in particular, will find that ABLs compete well against the high street banks.

Debt funds

Debt funds are lenders whose money comes from underlying investors, such as pension funds, rather than a bank balance sheet. Their return expectations are typically higher than that of the banks, and it’s the uptick in overall borrowing costs following the credit crunch that allowed them to become viable lenders in the UK.

What borrowers get for their money is a product that looks a bit more like a bond, in that it’s typically ‘interest-only’ and can often achieve higher leverage than bank debt. There are now well over 100 players in the UK market alone.

Good old (and challenger) banks

The banks have responded to these new challenges by upping their own game. Most of the mainstream banks now also offer ABL lending, and many have amended their loan offering to compete with debt funds, for example by allowing loans that are interest-only or have lighter repayment profiles.

That said, different banks have reacted differently in the face of the pandemic – not all have the same appetite to compete for new business. This has helped to accelerate the emergence of newer ‘“challenger’, banks, and to reinvigorate the existing challengers.

What’s the money for? Some hints and tips for the most common uses

How you present your credit case to the lender should account for what the money you borrow will be used for, and will determine how much you’re loaned.

Of the 60 per cent of respondents who say they would take on more debt in the coming months, just under 60 per cent say they would do so either to increase headroom (34 per cent) or for organic growth (25 per cent).

This suggests that when you’re looking to borrow to increase headroom, it’s because you need it for working capital, or as a ‘rainy day fund’. In either case, lenders will want to see why you are asking for the amount you are. When you present your downside scenario, you will need to be careful to balance being realistic and prudent, against giving too much of a negative impression.

When financing organic growth, the common issue is that there is almost always a lag between the growth in the business and the increase in the debt. This lag means that, for a period of time, the leverage may be higher than lenders feel comfortable with. In such a case, consider staging your request – rather than asking for all the money up front, asking for the funds in stages. should help lower the maximum leverage multiple, as you allow the business to grow before you reach your peak debt levels.