Once a private equity (PE) firm begins working with a management team, the active journey to create value starts. All parties involved have ambitious objectives and a relatively short timeframe to create and realise value. There’s a lot of pressure, a lot at stake and a lot to achieve – our experts can help you prime your portfolio companies for success.

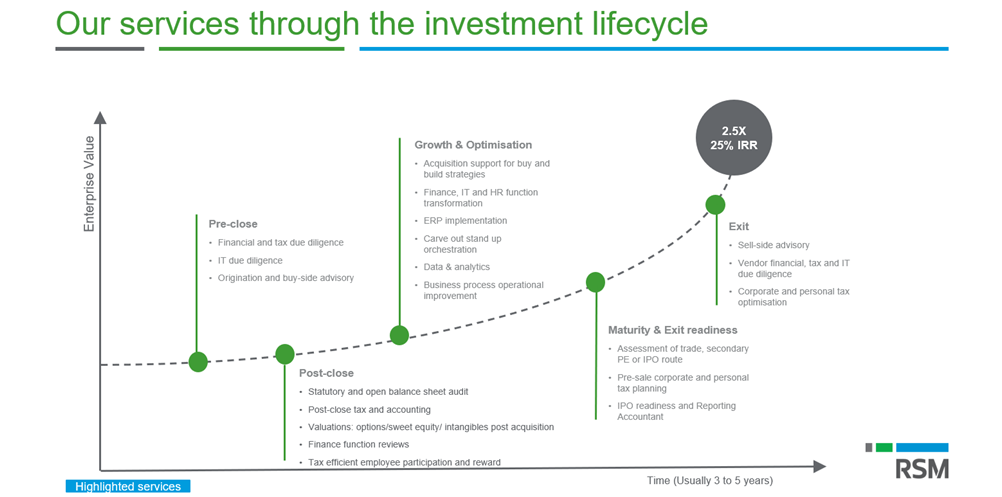

We offer a range of portfolio company services, delivered by PE-centric teams. We understand that your growth and risk mitigation strategies along with many initiatives must run concurrently, and we know the levers that PE typically pulls across the investment lifecycle.

Post-close

Post-deal accounting and tax advisory services help portfolio companies adjust to institutional ownership. By getting the right new structures to accompany a PE investment, we help management successfully create a foundation for growth.

We can also address new reporting requirements of the tax and corporate structure and related issues identified in the due diligence process. By resolving issues early, resources can then be focused on growth to maximise value at the next transaction.

Growth and optimisation

We provide a wide range of services during the growth phase. We support with expanding core business functions including finance, IT and HR, as well as optimising the operating model, overseeing digital transformation and implementing risk management.

Our accounting, financial reporting and tax teams ensure ongoing compliance, while our due diligence and tax structuring and advisory teams help evaluate and deliver successful add-on acquisitions.

Maturity and exit readiness

We help shareholders to start realising value from the investment through refinancing. We also optimise corporate and tax structures, for both the company and management team. Our financial reporting teams will help international businesses to convert accounting into other reporting standards as needed.

Exit

Our vendor due diligence services help bring certainty to sales discussions and increase competitive tension.

Our lead advisory team combines a thorough understanding of the company's sector and its key buyers with deep knowledge of mid-market investors. Through our extensive global reach, we can identify and access a broad, international range of potential buyers and create a bespoke and efficient competitive sale process.

PE Business Leaders Programme – a unique proposition

As a value-added service for our PE clients, our PE Business Leaders Programme attracts key talent for portfolio companies. We build strategic long-term relationships with best-in-class CEOs, CFOs, chairs and non-executive directors who are placed into portfolio companies backed by our PE clients.

The PE Business Leaders Programme is focused on four key pillars:

- Building teams: We support our PE clients to find the best executives and non-executives for their portfolio companies and set up introductions that will add value in the future. We do this on a no-fee basis.

- Supporting careers: We support our business leaders to grow their professional network of PE contacts via personal introductions. We also put them forward for relevant roles.

- Professional network: We regularly connect our business leaders through events and training for networking and knowledge sharing.

- Market insight: We offer our business leaders market insight, thought leadership and regular communications, supporting their ongoing development.